Enhanced Transaction Data

Alleviating customers fears when encountering unrecognised transactions

Brief

The client had a problem with customers being unable to recognise transactions on their transaction history, and their proposed solution was to add logos to transactions.

Challenging the brief

I wasn’t convinced that simply adding logos was going to solve this problem the customers had.

I proposed a session of user research to explore what pain points these customers have with trying to identify transactions they don’t recognise.

User Research Round 1

We conducted 4 x 30 minute interviews with participants exploring how customers identify transactions and whether these are fraudulent or not.

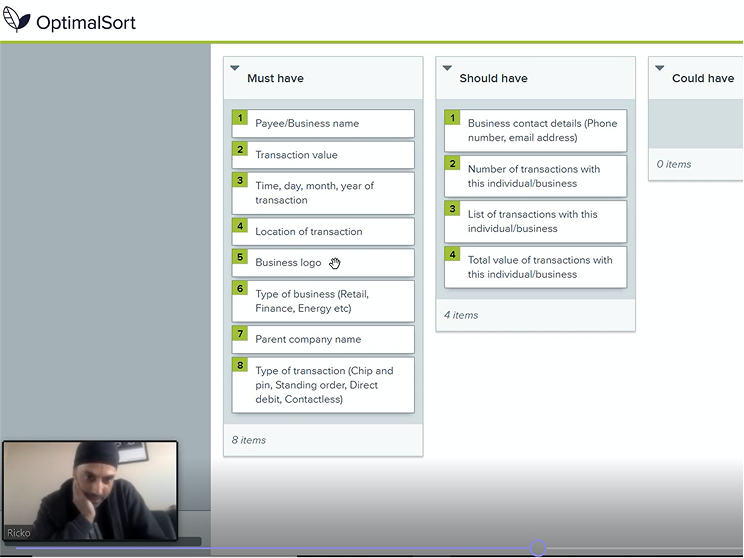

We also wanted to explore which details are fundamental to this understanding so we did a card sort exercise to gather this data.

Results

We discovered that when people can’t recognise a transaction, they retrace their steps.

The top 3 details they try to identify are:

1. Was I in that location?

2. Did I use my card that day?

3. How did I pay?

Design Exploration

Using the results from the user research I explored a variety of design directions to try to solve the problems that had been unearthed.

One of the other things I picked up from the research was each participant explained the sense of anxiety they feel when they have noticed a transaction they don’t recognise, and some mentioned that they had found it really difficult to report this to the bank.

This led me to explore this section of the app experience and I realised that the current process for a customer to report a suspicious transaction was difficult to navigate and generally unhelpful. I decided to explore ways in which I could improve this as well.

Before the project

The transaction history simply shows the transactions, amount and the date the transaction took place on.

The process for a customer to dispute a transaction was a long information page and a list of common retailers so the customer could check if their unrecognised transaction was one of those. Only at the bottom of the long information page it tells the customer that if they still can’t identify the transaction they should call customer support.

Designs for user testing

The designs for testing added transaction logos, location and time of each transaction.

The Transaction Detail screen also incorporated other details such as payment type, e-receipts and business information when applicable.

The process of disputing a transaction was enhanced to help make it easier for customers when they are in a state of worry.

User research round 2

We conducted 5 x 45 minute interviews testing 2 different prototypes. We explored participants understanding of the transaction list presented and their confidence in the legitimacy of each item.

We also explored how they would go about reporting a suspicious transaction.

Results

After multiple rounds of testing, it was revealed there was a strong customer appetite for enhanced transaction data. The location data scored the strongest addition from the testing and the transaction time scored highly too.

This was subsequently approved by my client and the first phases of adding logos and payment type were built and pushed live, with plans to push the next phases live shortly after.